Economic models of Stablecoins

To evaluate the economic models of coins commonly called Stablecoins, there are actually two types of approaches, but in principle, a stable coin should have zero volatility.

First, coin volatility is assessed, and if a stable coin functions as its name suggests, that is, is stable, its volatility should be close to zero (or ideally zero) and should not vary significantly and/or persistently over time. Otherwise, stable currency is not what it says it is.

Their risks vary significantly depending on their often unfamiliar structure, because if, for example, stable currencies are not depositories, they are something else, developed through a model that unifies different existing types of economics and information technology.

https://arxiv.org/pdf/2006.12388.pdf

Non-custodial stablecoins aim to be independent of economic institutions, and to achieve this goal, they are often implemented with smart contracts ( smart contracts ) on the Blockchain.

DAI is an example of a non-custodial Stablecoin

DAI, created by MakerDao, is the best example of non-custodial Stablecoin, managed through risk-absorbing cryptographic vaults, ETH collateral is deposited as the primary value, necessary for the issuance of Dai, secured by this collateral.

DAI lives entirely within the Ethereum blockchain, which is open for use by anyone, is resistant to the most opaque and large-scale forms of censorship, and interacts well with the on-chain infrastructure (accounts, DEX, etc.).

However, while in a normal condition, bank depositors have a guarantee of repayment of deposits, NC Stablecoin holders may not have such a guarantee, in the present case they must hope that the incentives of the system are aligned, to make the floating price of Stablecoins stable and liquid.

In addition, there could be attacks or malicious activities that could inherently commit fraudulent acts, such as stealing the value locked in the system, or acting on smart contracts.

In non-custodial stablecoins, it is the DAOs that decide the types of collateral allowed and the maximum amount per type, DAO is a smart contract intended to represent a structure of ownership or control over an asset or process, an incredibly broad term whose meaning has evolved greatly over the years.

Thanks to DAO in NC Stablecoins, forms of resilience are added that diversify issuers and jurisdictions, in fact can be said to be capital-efficient solutions.

However precisely because of this "fragile" structure these Stablecoins may in fact be subject to repeated issuer fraud or coordinated removal.

Stablecoin custodial, the case of Takamaka Red Token (TKR)

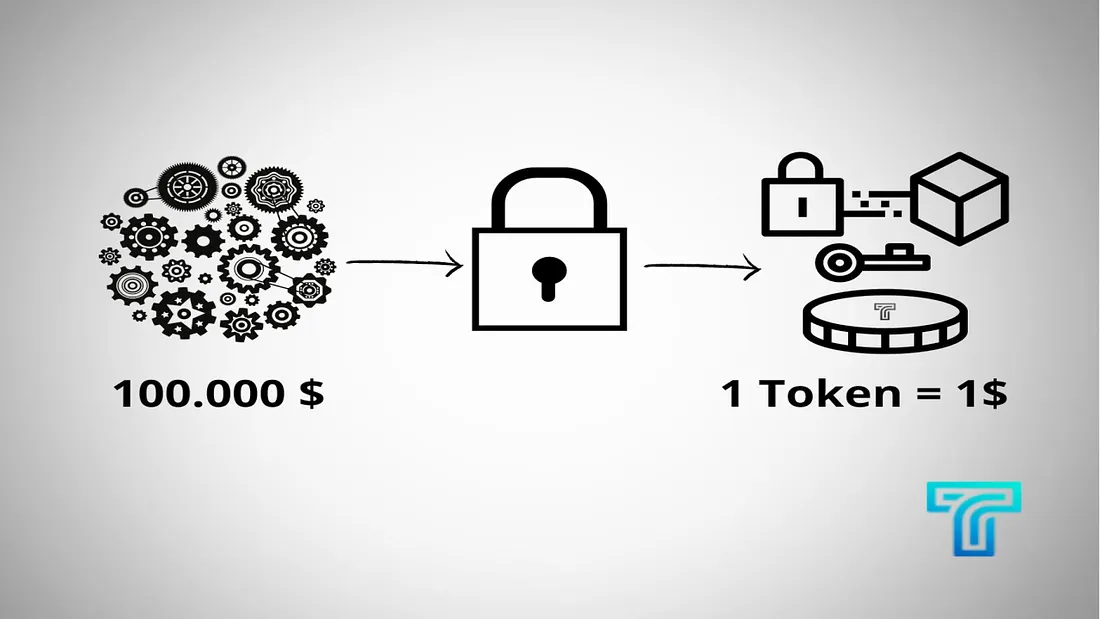

So-called "custodial" stablecoins are those in which off-chain collateral assets, such as fiat currencies, bonds and/or commodities, are held by an issuer who in return offers digital tokens to represent an on-chain version of a reserve asset, such as the U.S. dollar.

In this sense, digital token holders have some form of claim against the deposited custodial asset that maintains the peg, the main examples of deposits, such as Tether, Binance USD, USDC and TrueUSD have a combined market capitalization of several tens of Billions of dollars.

Coins therefore should be directly redeemable off the chain, because their value is immutable and always guaranteed by the issuing company in a 1:1 ratio, with respect to coin acceptance.

Takamaka's Red Token TKR for example, is a custodial stable token, which the AiliA sa company issues upon customer acceptance and deposit of a predetermined amount of fiat currency (e.g., TKR 1 = CHF 1).https://blog.ethereum.org/2014/05/06/daos-dacs-das-and-more-an-incomplete-terminology-guide

These (customer) credits take the form of deposits fully regulated by the Federal Banking and Savings Act (BBLR), and the deposits tied to the accepted fiat currency, against the issuance of TKR, are deposited in a single bank account opened in the name of the Issuing Company ( AiliA sa ).

It is not out of place to say that custodial Stablecoins, like the TKR, resemble electronic money in structure; they are a prepaid bearer instrument, whose deposits at a bank are covered 100 percent by reserves.

In the case of custodial Stablecoins, the governance is represented by a traditional legal entity, where the logic of issuance is rather easy to understand and the efficiency, as long as rules and parameters are met, is maximum.

On the contrary, it is undeniable to say that there are vulnerabilities for this type of Stablecoin as well; these types of Stablecoins tied to depositing with a bank certainly work today and almost certainly will work tomorrow.

But from a long-term perspective, their stability will continue to depend on the macroeconomic and political soundness of the United States, for example in the case of USDC, or the states where the issuing organization's jurisdiction is.

TAKAMAKA chose Swiss

Currently, the company AiliA sa, which created the Takamaka technology, has its registered office in Switzerland.

AiliA sa chose Switzerland because in the financial sector in particular, a fully regulated legal framework has emerged that is favoring the sector, allowing the potential of blockchain technology to be fully exploited.

Switzerland is one of the most advanced financial centers toward fintech and blockchain, thanks to a strict and timely regulatory framework that in fact allowed it to be among the first countries in the world to introduce legal provisions for blockchain technology.

In Switzerland, cryptocurrencies are subject to the same rules as real currencies, such as in the area of anti-money laundering.

Takamaka is fully VQF regulated, with continuous audits, so the company is actively working to stay in compliance with relevant international standards to avoid legislative loopholes and havens for criminal activities.

Stay Tuned.